The property tax process requires a considerable amount of planning and is ongoing throughout the year.

Step 1 – Assessment Notices

The Assessor’s Office is tasked with assessing all taxable property in the county at fair market value (less any exemptions) as of January 1st of each year. Assessment notices are sent by the first Monday in June. If you disagree with the assessed value of your property, contact the Assessor’s Office for appeals.

Step 2 – Taxing District Budgets

Every parcel is located within multiple taxing districts. In May of each year, taxing districts develop a budget to fund vital services for their communities. This process requires a budget hearing and is open to the public. This is a great way to get involved and meet elected officials who authorize and manage local spending. You can find your taxing districts and the district hearing dates on your Assessment Notice.

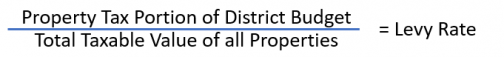

Step 3 – Levy Rates

The portion of a taxing district’s budget that is funded by property tax is divided by the total taxable value of all properties within that taxing district to determine the levy rate.

Step 4 – Your Tax Bill

Ada County issues a consolidated property tax bill on behalf of approximately forty taxing districts. You can review the levy rate of each district here: Levy Rates by Tax District

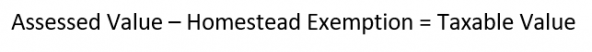

The assessed value of your property less any exemptions is the taxable value used to determine your taxes. A common exemption is the Homestead Exemption which exempts 50% of your home’s value up to $125,000.

To calculate your tax amount, the district levy rate is multiplied by your property’s taxable value to determine the tax amount for the taxing district.

This same process is repeated for each taxing district (city, school district, sewer district, fire district, library district, etc.).

Each taxing district, levy rate, and tax amount are listed on your property tax bill. The district tax amounts are added together to determine your total tax amount.

| Taxing District | Levy Rate | Tax Amount (based on $200,000 taxable value) |

| County | .002953537 | $590.71 |

| School | .004658860 | $931.77 |

| City | .007116767 | $1,423.35 |

| Special Dist. (highway, EMS, cemetery, etc.) | .001251735 | $250.35 |

| TOTAL | $3196.18 |

For more information on the different property tax rolls, please visit the Property Tax Rolls page.

For information on how to pay your bill, please visit Pay by Phone, Mail, or in Person.